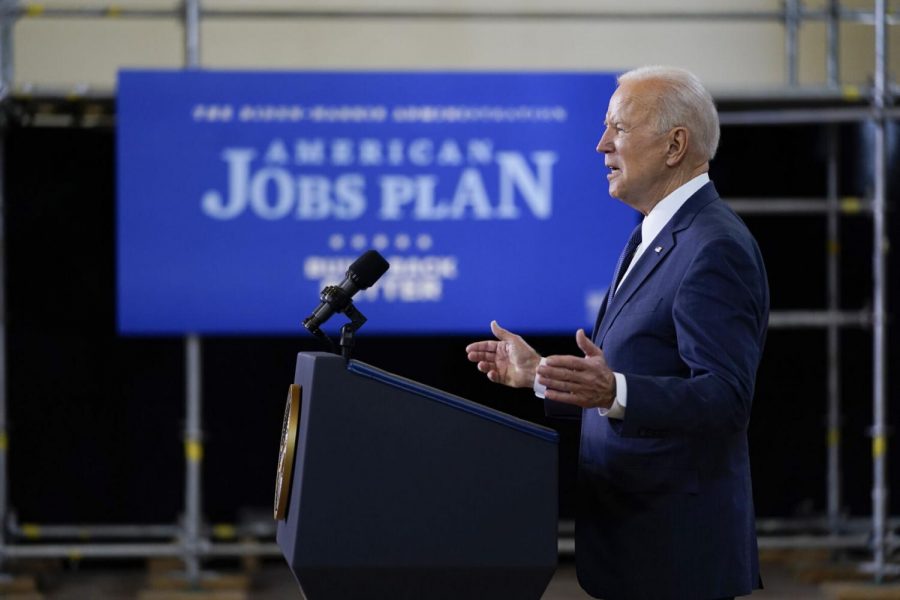

Rice economists: Biden’s tax increases would kill 1 million jobs in two years

April 12, 2021

(The Center Square) – President Joe Biden’s proposed tax increases would result in the loss of 1 million jobs in the U.S., Rice University economists estimate in a new report.

The study, “Dynamic Estimates of the Macroeconomic Effects of Tax Rate Increases and Other Tax Policy Changes,” published by Rice University economists John W. Diamond and George R. Zodrow, is based on several tax proposals suggested by the Biden administration.

Biden has proposed increasing the corporate tax rate from 21% to 28%, reinstating the corporate alternative minimum tax, increasing the top individual tax rate, and amending several other aspects of the tax code.

Their findings conclude “quantitatively what manufacturers from coast to coast will tell you qualitatively: increasing the tax burden on companies in America means fewer American jobs. One million jobs would be lost in the first two years, to be exact,” National Association of Manufacturers President and CEO Jay Timmons said in a statement. The National Association of Manufacturers sought the study.

The economists utilized the Diamond–Zodrow general equilibrium model to examine the short- and long-run impacts of possible tax changes on the macroeconomy. Based on their calculations, if Biden’s proposals were implemented, total employment, measured by hours worked, would initially fall by 0.7%, or 1 million full-time jobs in 2023. These lost jobs “would still be gone in 2026 before stabilizing,” they write. The average annual reduction in employment would be equivalent to a loss of 600,000 jobs every year over 10 years.

By 2023, the U.S. GDP would decline by $117 billion; by 2026 it would decline by $190 billion, they project. Ordinary capital, or investments in equipment and structures, would be $80 billion less in 2023, $83 billion less in 2026 and $66 billion less 2031, the economists project.

Investments in intangibles, or “firm-specific capital,” which are highly mobile and more sensitive to marginal tax rate changes, would fall 2.7% within two years, they project. Within five years, they would decline by 3.8%.

“After decades of advocating for a tax system that provided competitive rates and modern international tax provisions, manufacturers in America kept our promises following the enactment of the 2017 tax reforms: we raised wages and benefits, we hired more American workers, and we invested in our communities,” Timmons said. “If we undo those reforms, all of that will be put at significant risk. Manufacturing workers will lose out on jobs, growth and raises. We should be building on that progress, not rolling it back. But the conclusion of this study is inescapable – follow through with tax hikes that give other countries a clear advantage and we’ll see far fewer jobs created in America.”

After the 2017 Tax Cuts and Jobs Act, manufacturing growth exploded. In 2018, manufacturers added 263,000 new jobs, the biggest increase in manufacturing job creation in 21 years.

In 2018, manufacturing wages also increased, initially by 3%, by 2.8% in 2019 and by 3% in 2020.

Manufacturing capital spending also grew by 4.5% and 5.7% in 2018 and 2019, respectively. And manufacturing production grew 2.7% in 2018, with December 2018 being the best month for manufacturing output in a decade.

The manufacturing industry employs more than 12.3 million people in the U.S. and contributes $2.32 trillion to the U.S. economy annually. The industry has the largest economic multiplier of any major sector and accounts for 63% of private-sector research and development, NAM notes.

Raising the federal corporate tax rate to 28% from 21% is a critical piece of Biden’s $2.3 trillion infrastructure plan, a bill that has been criticized for the majority of funding being allocated to projects and initiatives entirely unrelated to infrastructure.

Treasury Secretary Janet Yellen argued in a Wall Street Journal op-ed that the 2017 tax reform act “creates an incentive for U.S. companies to offshore their workers and investments – and to shift their profits to tax havens.”

U.S. Rep. Kevin Brady, R-Texas, and architect of the 2017 tax reform bill, said Yellen’s op-ed is “misguided” and “inaccurate.”

In an interview with Fox Business, Brady said, “In my view, their tax proposals coupled with what we’ve seen out of the Senate will trigger a second wave of U.S. companies moving their jobs and research overseas. Biden’s tax policy actually makes it better for a foreign company to operate in America, than an American company to operate here at home,” Brady said.

“This policy is very dangerous to blue-collar workers.”

![Students cheer for Senator at Large Jaden Marshall after being announced as the Intercultural Student Engagement Center Senator for the 24th Senate on Wednesday, April 17 in the Senate Chamber in DSU. Ive done everything in my power, Ive said it 100 times, to be for the students, Marshall said. So, not only to win, but to hear that reaction for me by the other students is just something that shows people actually care about me [and] really support me.](https://wkuherald.com/wp-content/uploads/2024/04/jadenmarshall-1200x844.jpg)